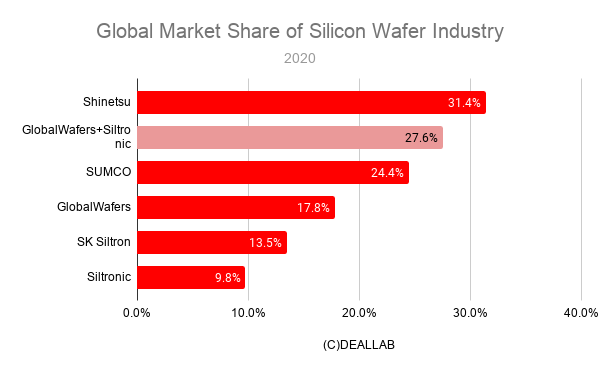

This page analyzes the global market share, industry ranking and market size information of the silicon wafer industry. The report also provides an overview of the world’s leading silicon wafer companies, including Shin-Etsu Chemical, SUMCO, Siltronic, GlobalWafers and SK Siltron.

Market Share of Silicon Wafer Industry

Using the FY2020 sales of each silicon wafer company as the numerator and the market size described below as the denominator, a simple calculation of the silicon wafer industry’s market share in 2020 shows Shin-Etsu Chemical in first place with 31.4%, SUMCO in second with 24.4%, and GlobalWafers in third with 17.8%.

- No. 1 Shin-Etsu Chemical 31.4%

- No. 2 SUMCO 24.4%

- No. 3 Global Wafers 17.8%

- No. 4 SK Siltron 13.5%

- No. 5 Siltronic 9.8%

In first place is Japan’s Shin-Etsu Chemical, and in second place is SUMCO. In third place is Taiwan’s Global Wafers, which is rapidly expanding after acquiring SunEdison. In fourth place is South Korea’s SK Siltronic, which was acquired by SK Group from LG in 2017, and is strengthening its semiconductor business through the group’s memory giant SK Hynix. Siltronic is a subsidiary of Wacker Chemie, a German chemical manufacturer.

The market is characterized as an oligopolistic one, with the top five companies accounting for over 90% of the total market.

Market Size

DEALLAB calculates the market share of the silicon wafer industry based on the global market size of $11.2 billion in 2020. The data used for reference is as follows.

According to research firm Modor Intelligence, the industry will be worth $10.8 billion in 2020, and is expected to grow at a CAGR of 6.1% through 2026.

According to Market Research Future, the industry will be worth $9.6 billion in 2019 and is expected to grow to $11.9 billion by 2025. According to Siltronic, the market size in 2019 is $11.2 billion.

Silicon wafers are an indispensable material for manufacturing semiconductor products. It is also known as the “foundation of semiconductors. TSMC of Taiwan, Intel of the U.S., and Samsung of South Korea, all of which are at the forefront of semiconductor miniaturization technology, are currently dependent on two Japanese companies for the procurement of the most advanced 5-nanometer wafers that determine the performance of their final products. In contrast to the miniaturization and integration of semiconductor circuits, the source of technological differentiation is the large diameter of the foundation. Wafers are defective if they contain microscopic dust or distortions, and Japanese companies are said to have an advantage because they possess the technology for mass production. Development for the next generation of 450mm wafers will continue.

How to make a silicon wafer

(1) Remove impurities from silica stone (silica, SiO2) to make silicon (polycrystalline silicon).

(2) Crush the silicon (polycrystalline silicon).

(3) Heat the silicon in a crucible (made of quartz, etc.) until it melts.

(4) Put a stick of seed crystal into the melted silicon.

(5) Silicon attaches to the seed crystal, forming a silicon ingot.

(6) Cut the silicon ingot into a thin circular shape to make a silicon wafer.

Difference between silicone and silicon

Silicon (silicon) refers to silicon (Si). It is the main raw material for semiconductors. Silicon oxide (silica) is found in large quantities in the soil (the main component of sand). Silica is also the main component of quartz (crystal). Silicone is a synthetic organic compound (silicon resin) that does not exist naturally. It is the main ingredient in adhesives and coatings. The Luxe steam case, which is useful for cooking, is also made of silicone.

Merger and Acquisitions

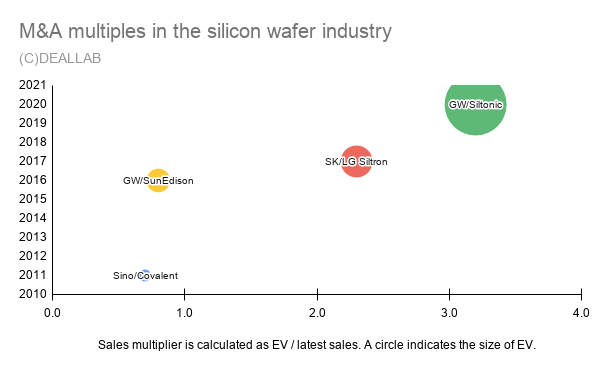

Taiwanese and Korean manufacturers are aggressively acquiring silicon wafer manufacturers. As the oligopoly continues to grow, the M&A multiples (sales multiples) are also getting larger.

2020 Global Wafers acquires Siltronic.

2017 SK Group acquires silicon wafer business (now SK Siltronic) from LG

2016 Global Wafers acquires SunEdison Semiconductors

2011 Sino American Silicon Products acquires silicon wafer business from Covalent

Overview of the major silicon wafer manufacturers

Shin-Etsu Chemical Industry

Shin-Etsu Chemical Industry is a leading chemical manufacturer in Japan. It has strengths in polyvinyl chloride and semiconductor wafers. In the semiconductor wafer business, it has become the second strongest player with SUMCO. The company was founded as a joint venture by Japan Nitrogenous Fertilizer (now Chisso Corporation).

SUMCO

SUMCO was established in 1999 as a joint venture between Nippon Steel & Sumitomo Metal Corporation (now Nippon Steel Corporation) and Mitsubishi Materials Corporation. It is a twin of Shin-Etsu Chemical in the field of semiconductor wafers.

Siltronic

Siltronic is a leading semiconductor wafer company based in Germany. It is a subsidiary of Wacker Chemie, a German silicon related product company.

GlobalWafers

The company is part of Sino-American Silicon Products (SAS), a Taiwan-based silicon wafer manufacturer led by Xu Xiulan, the Queen of Wafers. In 2012, SAS acquired the silicon wafer business from Covalent Materials (Coor’s Tech), a former Toshiba semiconductor company, and has been expanding its scale with the acquisition of Topsil and SunEdison Semiconductors in Denmark in 2016.

SK Siltron

SK Siltron is the former LG Siltron. Acquired from LG by SK Group in Korea. It is a semiconductor wafer manufacturer for photovoltaic panels based in Korea.