This document analyzes the market shares, market size, and mergers and acquisitions (M&A) activity in the Heating, Ventilation, and Air Conditioning (HVAC) industry in North America.

It also provides an overview of the key HVAC players active in North America, including Japanese player Daikin and U.S. peers Trane Technologies, Carrier Corporation, Johnson Controls and Lennox International.

DealLab expects further industry changes to occur in the future following the spinoffs of Carrier Corporation from United Technologies and Trane Technologies from Ingersoll-Rand.

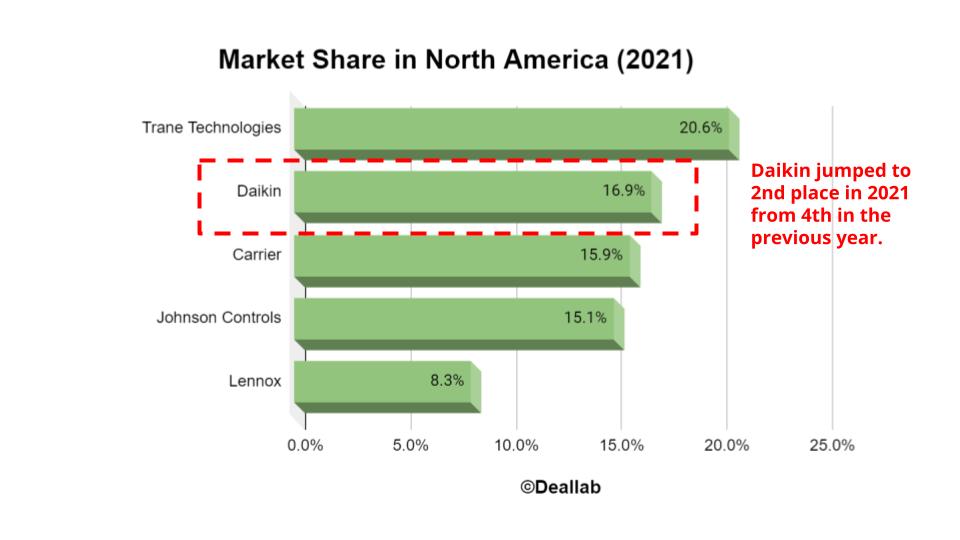

North America Market Shares (2021)

The market shares can be estimated using the HVAC segment revenue of each HVAC company in North America in 2021 relative to the overall market size estimated in the following section.

On that basis, Trane Technologies appears to be the market leader in North America, followed by Daikin, Carrier, Johnson Controls and Lennox.

| Ranking | Company | Market Share |

|---|---|---|

| No.1 | Trane Technologies | 20.6% |

| No.2 | Daikin | 16.9% |

| No.3 | Carrier | 15.9% |

| No.4 | Johnson Controls | 15.1% |

| No.5 | Lennox | 8.3% |

Source: DealLabs’ estimates of each company’s North American HVAC revenue in January-December 2021 based on annual reports and other data.

Source: DealLabs’ estimates of each company’s North American HVAC revenue in January-December 2021 based on annual reports and other data.

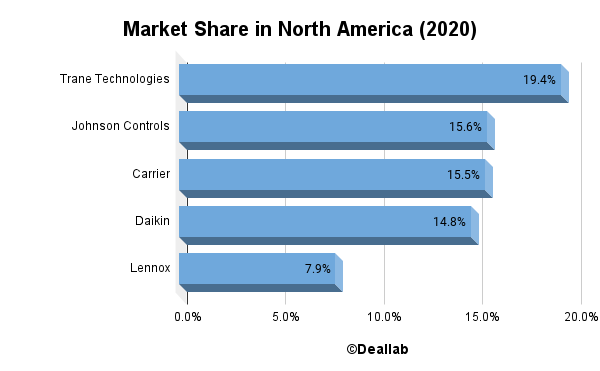

Compared to 2020 when Trane Technologies was in first place, Johnson Controls in second, Carrier in third, and Daikin in fourth, the significant difference in 2021 is that Daikin has moved up to the second place.

Source: DealLabs’ estimates of each company’s North American HVAC revenue in January-December 2021 based on annual reports and other data.

The North American market is dominated by duct-type air conditioning systems. This has historically been a barrier to entry for Japanese HVAC players who specialize in ductless air conditioning systems.

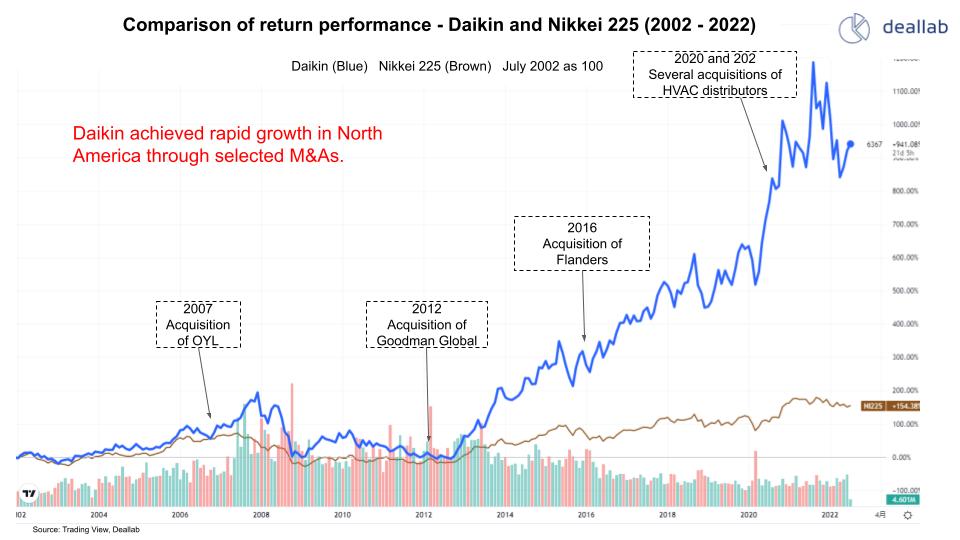

In order to expand its range of locally suitable HVAC equipment, Daikin acquired McQuay (OYL Industries) in 2008, Goodman Global in 2012 which was strong in residential air conditioning equipment, and Flanders in 2016 which was strong in air filters.

The combination of Daikin’s core strengths in energy saving, inverter and refrigerant technologies is considered to be the key driver for its recent rapid growth in North America.

In addition, to strengthen its distribution channels and complement its maintenance and servicing capabilities, Daikin acquired Abco, Thermal Supply and AirReps in 2020 and 2021.

Along with the expansion of its U.S. operations, Daikin’s market capitalization has also outperformed the Nikkei 225 since 2012.

Evolution of Daikin’s M&A and Market Capitalization

Snapshot of key metrics

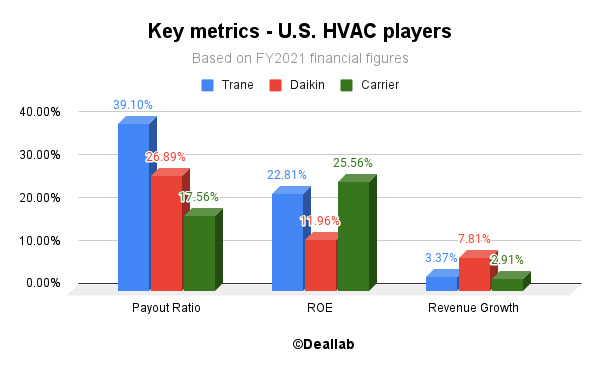

The table below summarizes dividend payout ratio, ROE and the revenue growth rates (over the past three years) of Trane Technologies, Daikin, and Carrier.

Daikin has outperformed competitors in terms of sales growth, Carrier in terms of ROE, and Trane in terms of dividend payout.

*Dividend payout ratio is calculated based on TTM as of July 8, 2022.

**ROE is calculated based on net income for the previous fiscal year and the average amount of shareholders’ equity at the beginning and end of the fiscal year.

***Sales growth rate is calculated as the compound annual growth rate (CAGR) over the past three years.

Revenue breakdown by region

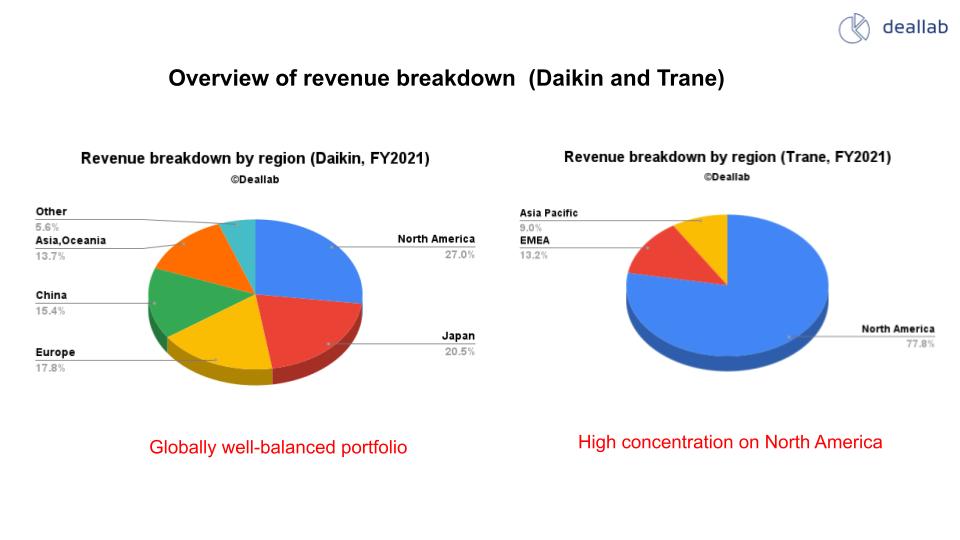

Looking at revenue by region, the two U.S. companies Trane Technologies and Carrier focus on the North American market, while Daikin has a well-balanced geographical presence with a strong footprint in the U.S., China, Japan, and Europe.

The revenue composition of Trane indicates that even HVAC giants face challenges to expand globally due to differences in consumer preferences and product technologies in each region.

However Daikin was able to overcome such difficulties through M&As followed by successful post-merger integrations, and plans to further expand globally going forward.

Market Size (U.S. and Global)

Based on third-party market research data laid out below, DealLab estimates the North American HVAC industry was worth $43.6 billion in 2021 (average of market size estimates from two data providers).

According to Fortune Business Insights, the North America HVAC system market size was $39.82 billion in 2020 and $41.67 billion in 2021. The market is expected to grow at a 5.2% CAGR from 2022 and reach $62.31 billion by 2029. Potential market growth is expected to be driven by further demand in inverter technology as well as significant energy-saving green building and smart city investments.

According to Expert Market Research, the North America HVAC market reached a value of about USD 45.64 billion in 2021. The market is expected to grow further between 2022-2027 at a CAGR of 4.1%.

| Year | Market Size | Growth Rate |

|---|---|---|

| 2029 | $62.3BN | 5.2%** |

| 2021 | $43.6BN | 9.5%* |

| 2020 | $39.8BN | n/a |

*Year-on-year growth rate

**CAGR from 2022 to 2029

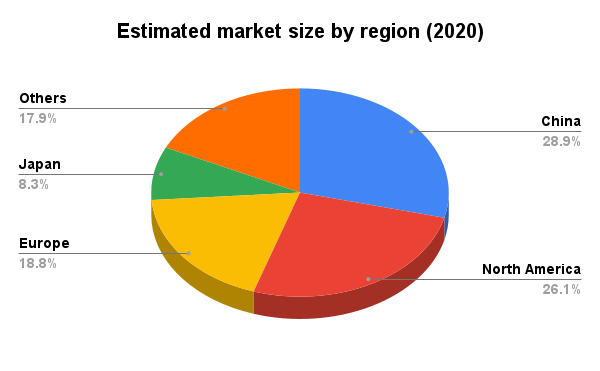

The global market value of the HVAC industry is estimated to be $200 billion in 2021. North America is accounting for approximately 20-30% of the global market.

According to Mitsui&Co global strategic studies institute, the size of the global market in 2020 was 21.8 trillion yen, while the size of the Japanese market was approximately 1.8 trillion yen. The North America market is estimated to be about three times the size of the Japanese market.

Source: Mitsui&Co global strategic studies institute

HVAC market overview

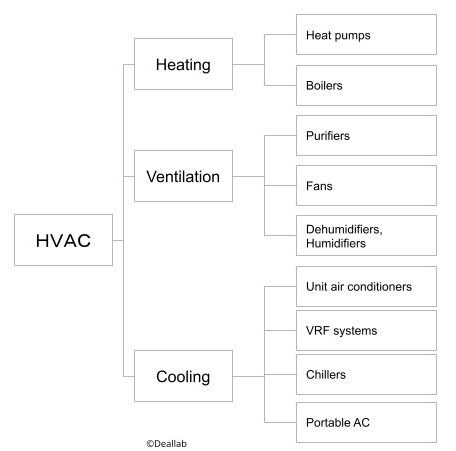

The HVAC market is classified into two segments: the equipment segment, where industry players manufacture and sell HVAC equipment such as heating, ventilation, and cooling equipment, and the solutions segment.

In the solutions segment, companies are required to provide efficient energy management of entire facilities and buildings including maintenance. The segment has been expanding rapidly in recent years.

Heating, ventilation, and cooling equipment is further subdivided into heat pumps, boilers, purifiers, ventilation fans, dehumidifiers and humidifiers, unit air conditioners, VRF systems, chillers, and portable air conditioners.

Selected M&As in North America

- 1979 Acquisition of Carrier by United Technologies

- 2007 Acquisition of Trane Technologies by Ingersoll-Rand

- 2011 Acquisition of Carrier’s South American operations by Midea Group

- 2012 Acquisition of Goodman Global by Daikin

- 2014 Acquisition of Air Distribution Technologies by Johnson Control’s

- 2016 Acquisition of Flanders by Daikin

- 2016 Acquisition of Tyco by Johnson Controls

- 2018 Establishment of a joint venture by Mitsubishi Electric and Ingersoll Rand to sell ductless air conditioners

- 2018 Spin-off of Carrier by United Technologies

- 2020 Spin-off of Trane Technologies by Ingersoll-Rand

- 2020 Acquisition of air conditioning dealers Abco, Robinson, and Stevens by Daikin

- 2021 Acquisition of Toshiba’s stake in Toshiba Carrier by Carrier

- 2021 Acquisition of Thermal Supply and AirReps by Daikin

Key HVAC players snapshot

Daikin

Daikin is Japan’s leading HVAC manufacturer, founded in 1924. It is one of the world’s top manufacturers of industrial heating and air conditioning equipment. It has expanded its business globally by acquiring Goodman Global, which is strong in duct systems, and OYL, a major air conditioner manufacturer in Malaysia. The company is also engaged in the fluorinated compound and other chemical products business.

Carrier Corporation

Carrier Corporation is a leading U.S.-based HVAC manufacturer. In 2020, Carrier air conditioning operations were spun off from United Technologies, together with elevator (Otis) and aircraft components businesses. The company also has strengths in transportation refrigeration equipment and fire alarms.

Johnson Controls (York International Corporation)

York is a U.S.-based HVAC manufacturer and a subsidiary of Johnson Controls.

Johnson Controls is a U.S.-based company founded in 1885 that provides commercial HVAC control systems, security systems, fire detection systems, and building management services. The company invented the electric thermostat. In 2015, Johnson Controls formed a joint venture with Hitachi Appliances in the HVAC field. In 2016, it merged with Tyco International, which is strong in the fire alarm field. The company operates in 150 countries around the world, offering energy efficiency solutions and various automation businesses. It was strong in the field of automotive batteries but sold the business in 2018.

Trane Technologies

Trane Technologies is a U.S.-based HVAC manufacturer. The company was a subsidiary of Ingersoll-Rand, a U.S.-based manufacturer of transportation temperature control equipment, golf carts, and air compressors, and was spun off as Trane Technologies in 2020.

About Ingersoll-Rand

Ingersoll-Rand, a U.S.-based industrial equipment manufacturer founded in 1871, merged with Gardner Denver, a manufacturer of vacuum pumps, compressors, and other industrial machinery, in 2020. Prior to the merger, the HVAC business was spun off as Trane Technologies.

Top-class companies like Allegion in the security industry and Hussmann in the refrigerated showcase industry (sold to Panasonic in 2015) are spun off from Ingersoll-Rand. It is also strong in compressors and air tools and transport refrigeration equipment. Its golf cart business was sold to Platinum Equity in 2021.

Lennox International

Lennox is a U.S.-based HVAC manufacturer founded in 1895. The company's strengths lie in the residential and commercial air conditioning as well as commercial refrigeration businesses. In the refrigeration business, Lennox supplies unit coolers, fluid coolers, air-cooled condensers, air handlers and refrigeration rack systems to supermarkets, convenience stores, restaurants, warehouses, and distribution centers.