This report analyzes the global market share, market size and M&A. It also includes trends and overviews of major industrial robot manufacturers such as Fanuc, Yaskawa Electric, ABB, Kuka, Kawasaki Heavy Industries, Mitsubishi Electric, Stäubli and Comau.

Global market share of the industrial robot industry

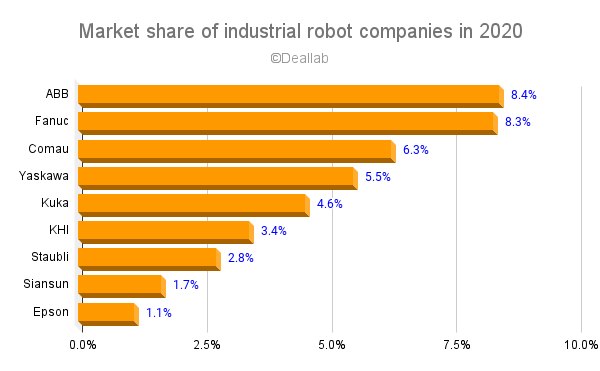

Using the FY2020 sales of the major industrial robot manufacturers as the numerator and the market size described below as the denominator, the global market share of the industrial robot industry in 2020 is calculated to be 8.4% for ABB in first place, 8.3% for Fanuc in second place, and 6.3% for Comau in third place.

- No.1 ABB 8.4%

- No.2 Fanuc 8.3%

- No.3 Comau 6.3%

- No.4 Yaskawa 5.5%

- No.5 Kuka 4.6%

- No.6 KHI 3.4%

- No.7 Staubli 2.8%

- No.8 Siansun 1.7%

- No.9 Epson 1.1%

In terms of global market share in the industrial robotics industry, ABB, a major Swiss manufacturer of heavy electrical machinery, is in first place, followed by Fanuc of Japan, which is strong in the computer control field, in second place. Comau, a subsidiary of Italy’s Strantis, in third place, Yaskawa Electric of Japan in fourth place, and Kuka of Germany, a member of China’s Midea Group, in fifth place.

In sixth place is Kawasaki Heavy Industries, a Japanese company that is strong in silicon ware transfer robots. In seventh place is Staubli, a Swiss company that originated as a textile equipment manufacturer. In eighth place is Siasun, the largest robot company in China. In ninth place is Epson, a Japanese company.

Market size

Deallab estimates the global market size of the industrial robotics industry to be $23.7 billion in 2020. The data used for reference is as follows.

According to research firm Modor Intelligence, the industry will be worth $23.7 billion in 2020, and is expected to grow at a CAGR of 20.4% through 2026. On the other hand, according to Fortune Business Insights, the market will be worth $21.8 billion in 2019, and is expected to grow at a CAGR of 15.1% through 2027.

There are 2.72 million industrial robots in operation in 2019, according to the International Federation of Robotics, an industry group. By country, China has the largest number with 780,000 units. In addition, the number of units supplied in 2019 is 390,000 units; the level was about 110,000 units in 2008 and over 250,000 units in 2016, with an average growth rate of about 4%. The market is expected to grow in the future as Chinese automobile and electronics manufacturers are expected to invest aggressively in industrial robots.

Types of industrial robots

There are four main types of industrial robots: vertically articulated robots, horizontally articulated robots, cartesian robots, and parallel link robots, each with different areas of expertise. Jointed industrial robots are often used in factories of automobile and electronics manufacturers. Industrial robots support production by performing tasks such as painting, assembling, polishing, cutting, transporting, welding, measuring, and inspecting in factories.

Industrial Robotics Fundamentals: Theory and Applications

Industrial Robotics

Trend of major manufacturers of industrial robots

FANUC

Fanuc is one of the leading factory automation companies in Japan. It is also one of the world’s largest manufacturers of industrial robots. It has the world’s largest cumulative sales volume of industrial robots. In FY2020, consolidated net income was 94 billion yen (up 28% y-o-y), and the operating profit to sales ratio recovered to 20.4%, indicating that the company’s investments in China are paying off.

Yasukawa

Yaskawa is a leading manufacturer of servo motors and inverters. It also strong in industrial robots and is developing industrial robots for a wide range of applications, from welding to transportation. In China, it has a factory in Jiangsu Province.

ABB

ABB, which stands for Asea Brown Boveri, was formed in 1988 by the merger of Sweden’s Asea and Switzerland’s Brown Boveri. Asea and Brown Boveri were founded in the 1890s and are two of the most established heavy electrical manufacturers in both countries. Asea and Brown-Boveri are two of the oldest heavy electric manufacturers in both countries, founded in the 1890s, with strengths in power generation and transmission equipment, automation equipment and software. In 2018, it acquired GE Industrial Solutions, an electrification business, from GE. In 2020, ABB sold the power systems and power grid business to Hitachi.

KUKA

KUKA is a German-based manufacturer of industrial robots. In 2016, the company was acquired by Chinese consumer electronics giant Midea Group. The company has strengths in welding, painting, and palletizing.

Midea Group

Midea Group is a China-based home appliance manufacturer founded by He Xiangjian in 1968, and listed on the Shenzhen Stock Exchange in 1993. It has strengths in home air conditioners and washing machines, and in 2016 it expanded its business by acquiring Toshiba’s home appliance division and German industrial robotics giant KUKA. The company’s founder, He Xiangjian, is a major shareholder through a holding company.

Kawasaki Heavy Industries

Kawasaki Heavy Industries is a leading manufacturer of servo motors and inverters. Kawasaki is also strong in industrial robots. It is developing industrial robots for a wide range of applications, from welding to transportation. In China, production is carried out at a plant in Jiangsu Province.

Staubli

Founded in 1892, Staubli is a leading Swiss-based manufacturer of robots for textile machinery. Its strength lies in horizontal articulated robots (SCARA). The company is also involved in fluid connectors, electrical connectors, and textile machinery.

Comau

Comau is a leading industrial robotics company based in Italy. Its strength lies in welding robots. It is a group company of Sterantis (formerly Fiat Chrysler Automotive (FCA)).